London, 22 March 2023 – In a first for Africa’s second most disaster-prone country, the Mozambique Government through the National Institute of Disaster Management (INGD) has purchased cyclone insurance in an effort to protect its most vulnerable populations from the increasingly frequent impact of cyclones. Africa Specialty Risks was the lead reinsurer in the inaugural Mozambique cyclone parametric placement. This innovative wind speed and rainfall cover was structured by PULA in collaboration with the World Bank.

This cover is designed to provide resilience to the Mozambique economy against the destructive effects of cyclones by providing the state insurer with a pay-out when certain triggers are met. There is USD 35 million of cover, based on carefully calculated thresholds. There are objective measurements of weather events, modelled to map to economic loss. This eliminates the need for a time-consuming and costly claims process and allows for the prompt provision of funds to support recovery efforts.

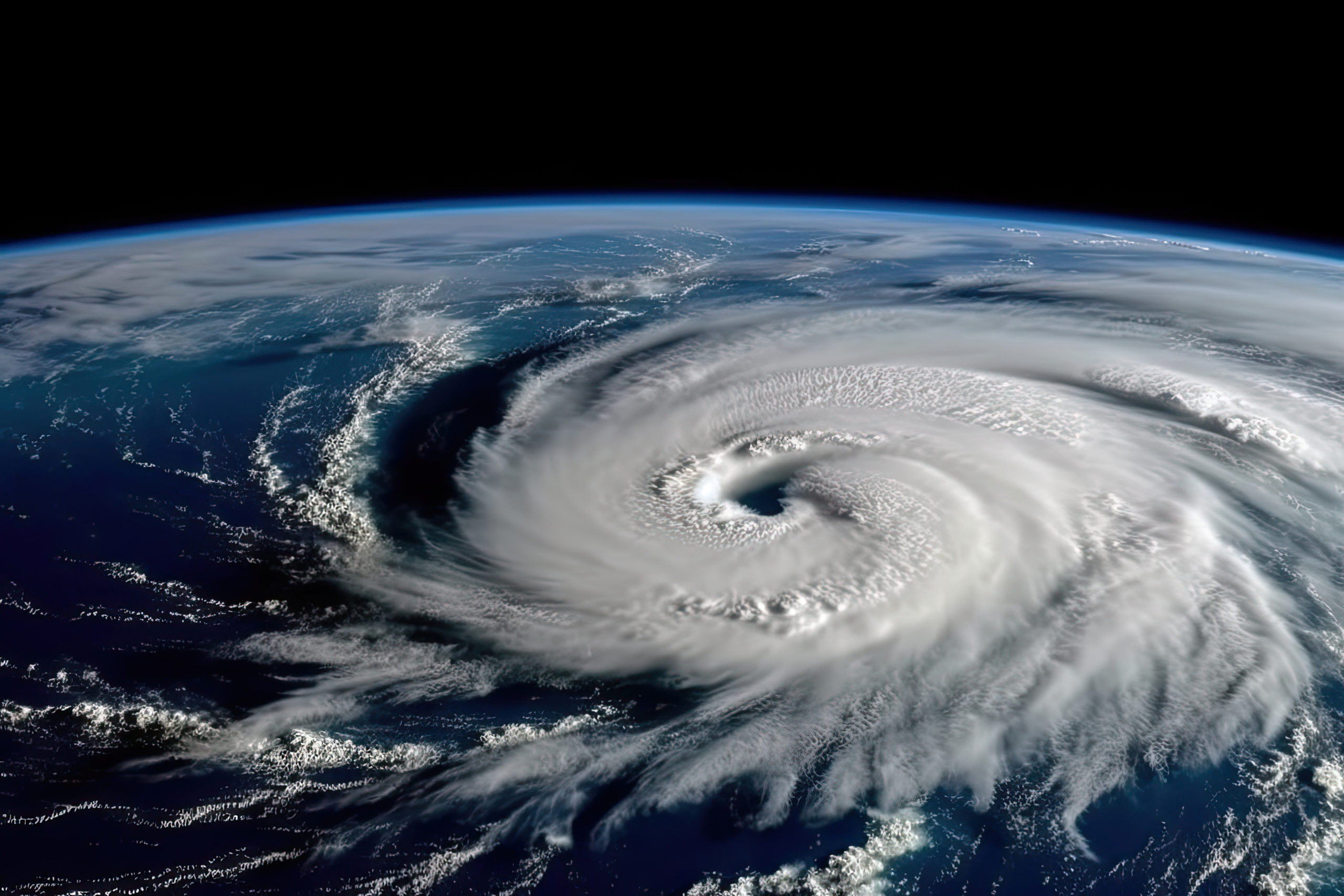

During 2022, natural disasters caused a USD 313 billion global economic loss: 4% above the 21st-century average, of which USD 132 billion was covered by insurance, or 42% of total, according to the 2023 Weather, Climate and Catastrophe Insight report, published by the global (re)insurance broker AON. In Africa severe flooding events were 2022’s worst natural disasters in Africa. Mozambique is Africa’s second most disaster prone country: tropical storms and cyclones in Mozambique have increased in frequency and intensity because of higher ocean temperatures brought on by climate change. Since January 2022, Mozambique has been affected by three tropical storms or cyclones, affecting over 900,000 people and destroying around 220,425 hectares of crops due to flooding.

While weather risk is routinely parametrised in the US, this programme is the first of its kind for cyclone cover in Africa, designed specifically for the continent, and continuing the growth of parametric disaster cover across the continent.

Antonio Jose Beleza, Deputy Director of the National Emergency Operations Center at INGD, commented: “The cyclone program will provide crucial funding and stability to the Mozambique people and economy. The program will help build resilience in the economy, and highlights the importance of building risk mitigation instruments outside of the standard disaster risk insurance specifically designed to meet the increasing cyclone risk to Mozambique.”

Dr Raveem Ismail, Head of Parametric Underwriting, Africa Specialty Risks, added: “This collaboration brings together the expertise of multiple organisations to provide a comprehensive solution for cyclone risk in Mozambique. We are confident that this program will make a real impact in reducing the economic impact of cyclones on the communities and businesses in the region. This is an important policy for Mozambique, one which has been designed in Africa, to meet the growing need for cyclone insurance, and is an example of what is possible for insurance products across the continent.””

Thomas Njeru, CEO, PULA, remarked: “We are pleased to have joined forces with the Institute of Disaster Risk Management of Mozambique, Africa Specialty Risks and the World Bank to deliver this cover to the Mozambique government. The program will help provide certainty for the most vulnerable communities in Mozambique, unlocking investment across the country with effective risk mitigation in place to protect against cyclones.”

-Ends-

Media Enquiries

Africa Specialty Risks

Mikir Shah, CEO

Ciaran O’Donnell, CFO

Via Tavistock

Tavistock Communications

Tim Pearson

Katie Hopkins

About ASR

Africa Specialty Risks (ASR) provides comprehensive risk transfer solutions through high quality underwriting to local and global customers across the African continent, giving them the confidence to grow their businesses sustainably.

ASR works proactively with local regulators to develop skills and provide training to local underwriters. Environmental, social, and governance considerations are central to ASR’s values, particularly in relation to local capacity building.

ASR is backed by Helios Investment Partners’ Fund IV and benefits from their extensive reach across Africa, as well as their knowledge and experience in our key markets.

Africa Specialty Risks Ltd is an Appointed Representative of Crispin Speers & Partners Ltd. We operate as a Managing General Agent sourcing world leading capacity for African insurance and reinsurance risk. We are a proud member of the MGA Association.

About Pula

Pula (www.pula.io) is an insurtech providing parametric insurance design and execution services, specialising in index based insurance, and backed by top tier VC investors who have invested more than $10mln in the business. Since 2015 Pula has provided climate insurance to 9.3 households, 31% of which were women across 19 markets in Africa and Asia who pay an average of $10 per season to insure their crops. So far Pula has unlocked over $1.7bln of capital from local and international insurance markets for climate risks since we started in 2015 and paid out $30mln to our clients.